If you find yourself undertaking or expanding your online business, there are numerous can cost you to adopt, out-of local rental possessions and purchasing gizmos to employing and you will studies staff. While you are a citizen, you will possibly not have considered utilizing your home collateral for providers funding, but it shall be a viable alternative to a normal short team loan. Read the positives and negatives of every out-of the options below.

SBA (Home business Government) Financing

A traditional small company financing, or SBA loan, is often the first avenue for many entrepreneurs seeking investment. Supported by the small Business Management, such funds are supplied from the banks, microlenders, and you will commercial loan providers and frequently element all the way down interest rates and a lot more independency than simply old-fashioned bank loans.

Yet not, one significant problem out-of conventional small company finance ‘s the red-colored recording and you can papers needed; of numerous inquire about an individual asset ensure to help you hold the financing. It is additionally vital to observe that if for example the organization is particularly small – state, if you find yourself the only real manager or one out of a few otherwise around three group – it could be particularly hard to safer that loan. It is estimated that just about 15% out of sole proprietorships have loans.

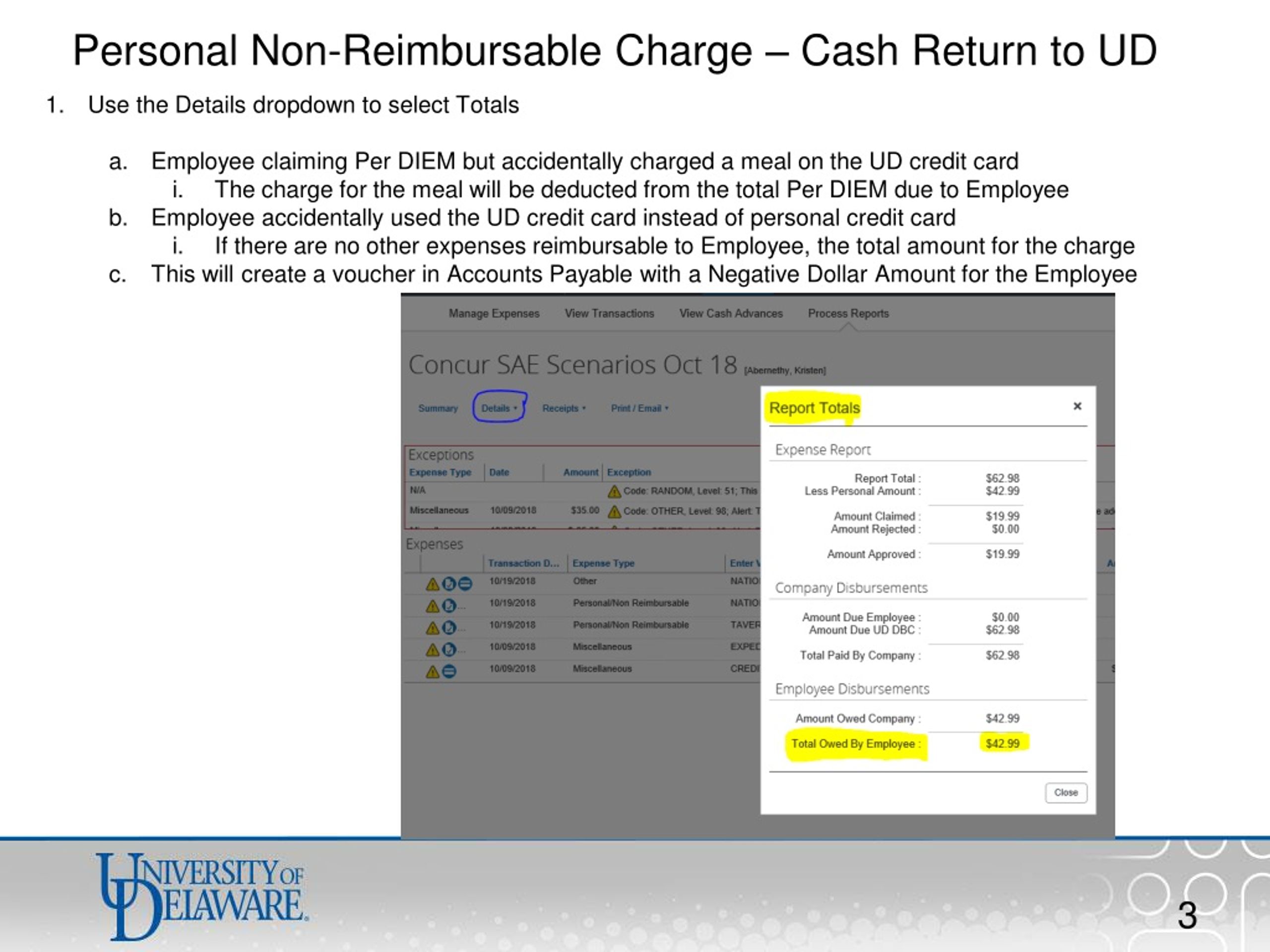

Household Security Financing getting Team

Property security loan allows you to borrow against brand new security you produced in your home, utilizing the the place to find make sure the financing. For the and front, these funds bring predictable rates, so that your payment per month remains the same per month, and is especially tempting if you are searching to utilize a family guarantee mortgage for company motives.

And you may as opposed to most team lines of credit, you aren’t expected to pay the balance right down to zero for each year. In reality, a home guarantee financing will be tempting because of its generally versatile repayment periods, and that typically start around 5 so you can 15 years. Concurrently, it’s possible your notice on the household guarantee loan usually be tax-deductible.

Yet not, property collateral loan is another home loan on the family, very you have to be ready to build an additional percentage on top of your existing mortgage. The application form and you may approval processes can also be a bit difficult because of lenders’ specific requirements.

Domestic Security Line of credit (HELOC) to own Providers

If you are searching to have independence, an effective HELOC to suit your small company is a good idea, as it offers the chance to accessibility financing any time and you will take out more as needed without having any charges. The application form and you can approval procedure along with is generally smoother than just other options. Just as in property collateral loan, there is certainly the possibility that the eye is tax-deductible, plus the installment period typically spans from 15 to 20 many years.

But really in place of a property collateral mortgage which generally enjoys a fixed rates, the latest varying interest of an excellent HELOC means that repayments will end up being volatile per month. While doing so, if your credit score otherwise house value reduces, the lending company normally freeze their HELOC when.

Family Collateral Investment

Property security funding provides you with cash in change for a beneficial express down the road property value your house, but rather than a loan otherwise HELOC, you do not have the trouble regarding monthly installments. You should use the bucks having one thing you want, whether it is buying equipment, to make place of work home improvements, or increasing operations. The fresh new timeline is additionally seemingly quick, and when you are accepted, you might found funds within about three weeks. 1 At otherwise till the avoid of one’s ten-seasons productive several months, you’ll want to settle new money – using a good re-finance, buyout with coupons, otherwise purchases in your home.

Along with household equity points, a homeowner is putting their property on the line hoping of cultivating the business’ triumph. But what tends to make property collateral financial support a little while distinct from the other choices ‘s the downside safety it offers. In case the home value depreciates throughout the years, the quantity that is owed so you’re able to home equity financing organization such as Hometap including goes down, and there is no protected return towards the financial support. And you will having said that, if a home observes quick fancy, Hometap’s upside was capped from the 20% of your Money for every year.

Tap into the collateral and no monthly installments. Find out if your prequalify to possess good Hometap capital in half a minute.

You should know

I carry out all of our far better ensure that the information from inside the this article is due to the fact exact you could as of the go out it is had written, but one thing transform rapidly often. Hometap cannot promote $255 payday loans online same day Maine otherwise monitor any connected other sites. Private issues disagree, so check with your own fund, tax otherwise law firm to determine what is reasonable for you.