We often get asked what is a keen FHA loan? and you will how come and FHA mortgage performs?. Better, if you are looking to own a house and require a loan with much easier credit requirements and you will a decreased downpayment, a national Casing Administration (FHA) financing would-be best for you.

A keen FHA financial is actually home financing which is supported by the fresh government and insured by Government Construction Management. When you find yourself FHA financing wanted monthly home loan insurance fees, this new financing requirements include a tad bit more versatile than just a conventional mortgage – and qualification techniques is usually a small simpler as well.

You can purchase a property for the number 1 residence having an effective deposit only step three.5%. Minimal FHA loan credit history try 580. If for example the credit rating is gloomier than just 580, you may still be eligible for capital when your percentage of your house financing was ninety% or smaller, when compared to the value of the property. That it proportion is called the loan-to-well worth, otherwise LTV. In cases like this, you might you prefer a down payment of at least ten% of one’s cost.

Very first Sites Lender also provides each other 29- and you will fifteen-year fixed-price FHA home loan choices for purchasing your family together with refinancing selection, with a credit score away from 620 and you can over.

FHA requirements

Truth be told, FHA mortgage loans are not only to own basic-big date homebuyers. However, there are various other criteria to remember:

- You really must be in a position to show You.S. residence and have now a legitimate Societal Safeguards number

- Your house you purchase which have an FHA mortgage need to be your number 1 household

- You truly need to have a reliable a job record and/otherwise become in one job for the past couple of years

FHA home have to be unmarried-relatives tools, but that isn’t just limited by house. Condos, townhomes and duplexes can be eligible.

Regardless of if you have had a current personal bankruptcy otherwise foreclosures, you may still qualify for a keen FHA mortgage in a few affairs. FHA funds also are susceptible to amount borrowed limitations one to count on the geographic area. Check out the Financial Limits webpage on the site.

Processes

- Find out if you’re entitled to an enthusiastic FHA mortgage by contacting a good HUD-recognized lending company such First Sites Lender (HUD is the U.S. Institution off Construction and you can Metropolitan Innovation)

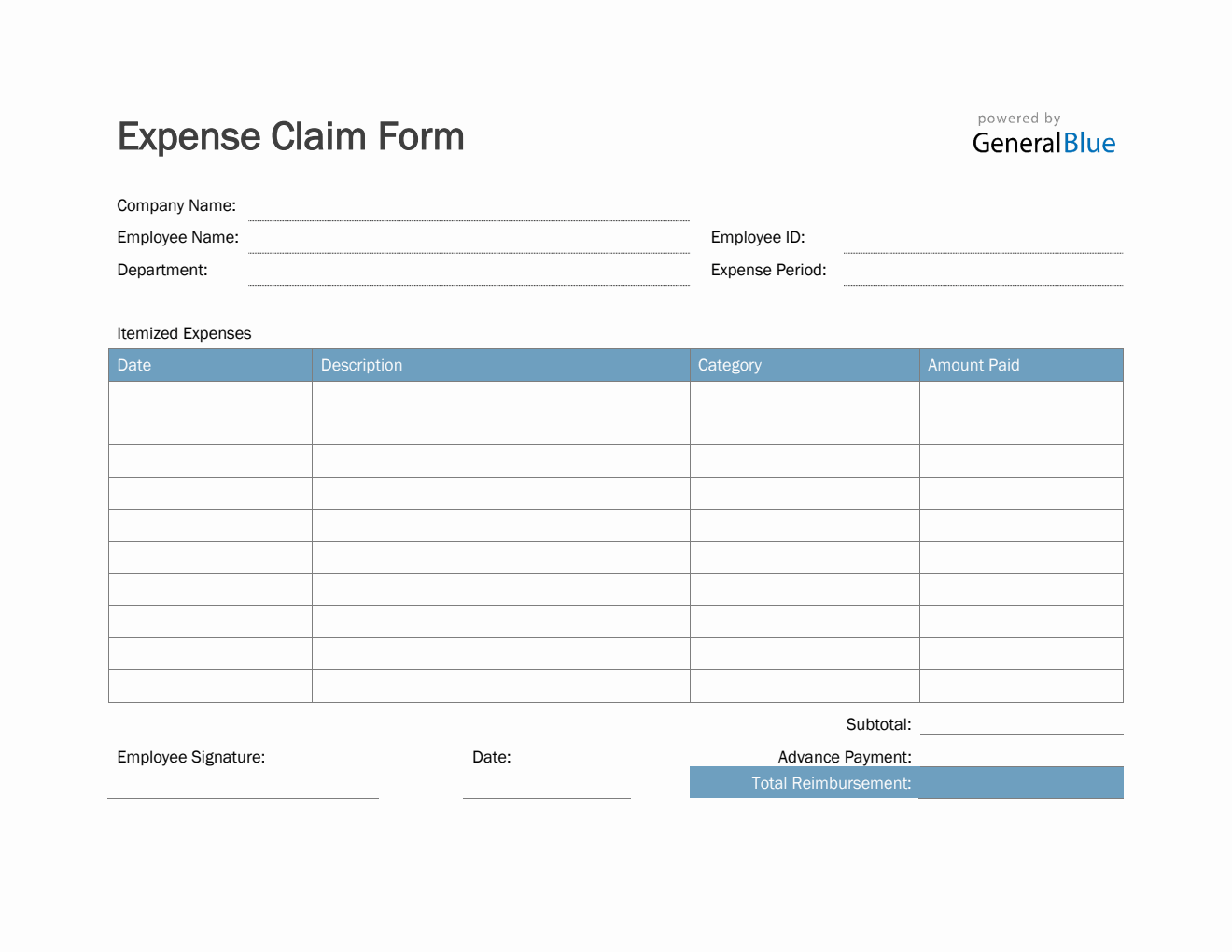

- Fill in your FHA mortgage application with your financial (friendly reminder: Earliest Internet sites Bank now offers FHA fund!)

- Their financial will plan a home assessment and you can inspection to determine the value of the home (facts less than)

- To decide for people who qualify for the necessary amount borrowed, your own a job, earnings, credit rating and you will personal debt-to-income ratio will be analyzed

- The big go out – closure! Indication the past deal, shell out any charge, have the points and you will transfer to your new domestic

Assessment and inspections

An effective HUD-approved appraiser need confirm that the home meets every national and you may/or condition strengthening requirements. New loans in Coosada appraiser usually number facts about the house on a domestic Appraisal Declaration:

- Level of room

The problem rating system uses a scale of 1-six to spot characteristics that will you desire tall solutions. Such recommendations determine the new livability of the property, any fitness otherwise security questions, and soundness and structural integrity. FHA land are checked to have unsafe criteria like radioactive content, harmful chemical and erosion.

Whilst FHA appraisal and you will inspection process become more stringent, it can save you monetary agony later from the helping you save off fixes who damage an already tight budget.

Knowing the criteria and restrictions initial can make you better wishing to obtain the investment for your home. If you think a keen FHA mortgage would be advisable to you, contact one of the knowledgeable financing specialist at the step one-866-742-5158 which have questions you could have.