If you are searching toward prime destination to phone call home and aren’t afraid of an effective fixer-top, consider to invest in a house in foreclosures. Foreclosures happens when homeowners don’t spend its mortgage and the bank takes straight back command over the house and you will resells they. Within the 2020, step one.6% of your own services indexed had been within the foreclosures. The advantage of to shop for a good foreclosed house is dependent on the newest amount of savings that you can get, as they are have a tendency to ended up selling less than market value.

Of numerous potential customers stray away from to acquire property inside foreclosures because the they are confused about various funding choices that are available. There is a large number of misconceptions available to you you to definitely end many potential customers away from capitalizing on particular incredible deals. In fact, some people was able to genitals some good belongings getting a cost that’s 20% lower than the market worth.

Basic some thing very first, among the many misconceptions of buying a property when you look at the foreclosure is you need to pay into the bucks.

It isn’t really possible. It simply hinges on the fresh stage of your foreclosure. Typically the most popular phase is the pre-foreclosures stage or even the financial-had stage. When you look at the pre-property foreclosure stage, our home are going to be marketed as a consequence of a system also known as an excellent quick purchases, and you can inside lender-had phase, the financial institution can try to sell the home as well. In both of those values, you can get a home for the property foreclosure sometimes having home financing otherwise a government-paid loan. About public auction phase, not, this is usually a tip which you’ll need to pay during the dollars – always having an excellent cashier’s sign in increments regarding $100,000. For individuals who show up on these types of auctions, you could potentially generally speaking locate fairly easily an earnings get domestic lower than industry well worth.

Without having h2o money on you, you could nonetheless purchase an effective foreclosed house or apartment with a home loan or a government-paid program. Let’s have a look at several of them Point Clear loans below.

203(k) Financing

One of several easiest regulators-backed resource choices to apply for is actually a good 203(k) loan. The brand new Government Homes Government designed that it loan to prompt people to help you spend money on high-chance REO sales. An important advantageous asset of it mortgage is you can use sufficient to not merely mortgage the home, as well as safeguards the price of renovations as well, that is particularly important regarding to invest in belongings in property foreclosure since they are tend to within the shorter-than-most readily useful says and you can requirements.

There have been two designs in the loan: a streamlined variation and a traditional variation. A streamlined 203(k) mortgage is supposed to have restricted fixes that don’t wanted people a lot more structural otherwise structural alter into the property, since the someone is use as much as $35,000 over the home’s sales price. The traditional variation is a bit harder and will require an inspection report regarding a different consultant. These types of loan can safeguards the cost of comprehensive solutions and you can renovations.

HomePath Ready Customer

An alternative choice is the HomePath ReadyBuyer program that is given by the latest Fannie mae (FNMA) of Fannie mae. This might be a loan that’s designed for earliest-time buyers, however it also can defense features which can be from inside the foreclosure. In order to be eligible for around step three% in closing prices recommendations, first-date customers need certainly to complete a compulsory degree way.

A conventional Financial

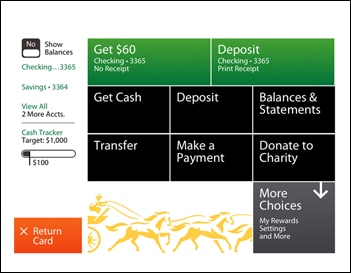

![]()

You may sign up for a traditional home loan even though you are curious about to buy a home in the foreclosures. The issue is that you will would like to get pre-recognized to own a home loan earliest prior to going shopping for good family when you look at the foreclosure. Just be pre-accepted, so you’re able to build a serious render towards a home just before it’s purchased of the other people.

While you are thinking of using that one, you ought to look around with several lenders to obtain the top pricing and you can terms and conditions it is possible to.

Family Guarantee Personal line of credit

A unique reasonable option is property Security Line of credit. You should buy certain resource assist for individuals who actually have security into the a property that you very own. This is simply not a home loan per se, however, properties a lot more like a charge card. These types of resource option can come from inside the convenient, once the loan providers usually are more than willing to extend lines of credit as much as 85% of the residence’s collateral. You might withdraw the total amount that you may need and simply pay attract to the certain quantity which you have lent.

The main benefit of this resource option is as you are able to easily get the funds that you might want rapidly. The fresh new drawback is the fact you are able to have a tendency to shell out high-rates of interest. Thus, getting a house guarantee personal line of credit isnt commonly a required services.

Difficult Money Money

Hard money loans usually are thought to be the last lodge. He could be an alternative choice to a mortgage and will be used by individuals who don’t qualify for a vintage home loan. Difficult money funds are often more straightforward to submit an application for and certainly will enable you to get the amount of money that you might want inside the a brief period of energy. In fact, you could potentially always apply for and also recognized for a loan within several days.

This can be an effective selection for those people who are ready to need large risks and wish to quickly pick and you can flip a great property foreclosure domestic which is marketed less than market price. Individuals who submit an application for these fund need a little a number of experience with the industry and you may know exactly what they truly are starting.

You should never Miss out on To purchase a property in Foreclosure

Foreclosure land should be a great deal, and you can unless you are within a public auction, you don’t need to buy foreclosures belongings into the dollars. There are many different authorities-sponsored capital solutions or other financing readily available for those people who are wanting such features.