Purchasing your basic home is a milestone which should be prominent, nonetheless it also can have pressures. House value keeps dramatically reduced because the activities eg rising prices, also provide shortages, and you can booming demand have increased pricing, driving many basic-big date homeowners outside of the industry. Casing costs have also increased faster than simply wages due to the fact 1960s, that has merely be more noticeable towards the recent pandemic.

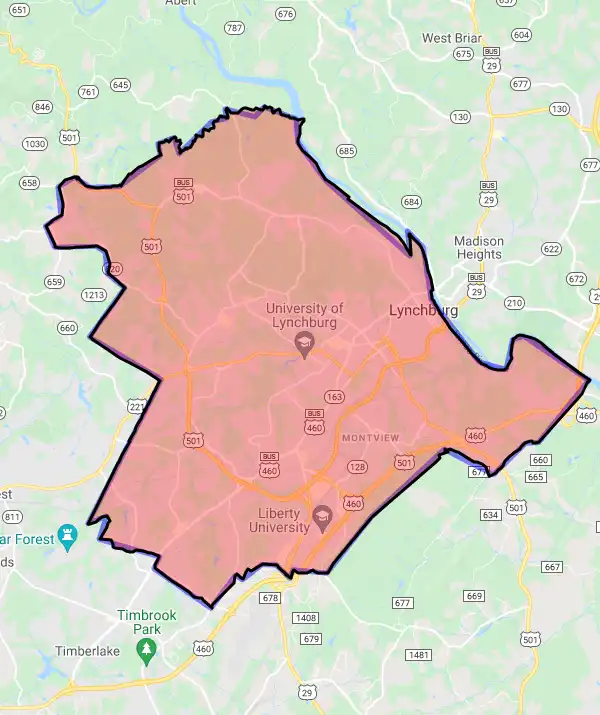

If you’re planning to repay off into the Georgia, the newest Peach County offers multiple resources to make the dream of home ownership alot more available. One which just get seriously interested in home browse, it is useful to know about different applications accessible to let Georgia residents pick their very first house.

The state concept of an initial-go out homebuyer tends to be greater than simply do you consider. The latest U.S. Agency out of Construction and Urban Creativity talks of an initial-go out homebuyer just like the somebody who:

- Has never purchased a home before,

- Have not ordered a house within the last 3 years,

- Only has had property that have an old companion that is now just one moms and dad otherwise displaced housewife,

- Has only owned a house that failed to follow strengthening codes and you may failed to feel current at under the cost of building another type of house, or

- Has only owned a house one to did not have a permanent foundation (instance a mobile home).

Georgia talks of they also. You may take advantage of earliest-date homebuyer applications when you look at the Georgia while you are to purchase from inside the a particular city.

2023 Georgia Homebuyer Analytics

- Average record rate statewide to own : $379,000

- Median day land take the latest : 64 weeks

- REALTORS Cost Score for Georgia in the (1.00 getting cheapest): 0.63

The new Georgia Fantasy System

Probably one of the most of use first-go out homebuyer apps Georgia has the benefit of is the Georgia Fantasy program, which gives basic-date homeowners around $7,five hundred to help protection its down-payment and no credit check payday loans in Merino Colorado you may closing costs. Many people-and additionally energetic army, teachers, health care gurus, and people having a family member having an impairment-would-be entitled to to $ten,000.

These advance payment assistance apps is actually no-appeal and also have no monthly premiums. You just pay back the mortgage once you sell, refinance, or escape of your own residence. In order to qualify, you truly must be a first-date homebuyer (n’t have owned property in the last three years otherwise package to find in a specific area) while having the lowest so you’re able to moderate income, that have restricted quick assets. Income restrictions are different predicated on household size and town.

Georgia Dream finance can be complement FHA, Va, USDA, and you can old-fashioned finance, as well as your bank can look at the Georgia Dream eligibility as part of one’s financing prequalification procedure.

Beyond the Georgia Dream program, you will find several other advance payment assistance software that help simplicity financial traps therefore much more Georgians becomes homeowners. I always highly recommend talking to their realtor and you may financial since you consider these style of software.

House Atlanta 4.0

If you have a good credit score (the least 660), a media (or low) money, and you can be eligible for a keen FHA otherwise Virtual assistant financial, you are permitted found an offer from your home Atlanta cuatro.0 for as much as 3.5% of purchase price regarding a different sort of family. It offer can be used to help protection advance payment and you can closing costs getting house around $375,000. As it is the outcome with many has, it does not must be paid down.

Atlanta Sensible Homeownership Program (AAHOP)

AAHOP offers to help you $20,000 to fund downpayment and you will settlement costs getting low-income Georgians that have the absolute minimum credit score away from 580. After you are now living in the house for five in order to ten years (with regards to the amount borrowed), new AAHOP loan was totally forgiven. As eligible, you should qualify for a 30-season repaired-rates Va, FHA, otherwise conventional financial as much as $272,000 otherwise $290,000, based on where you are.