Bridges manufactured so anybody can be overcome obstacles and get where they wish to go. In the world of a home otherwise organization, bridge investment is not any various other.

Usually employed by people to keep up with cash flow requires if you are waiting around for a lot of time-term financial support, a therefore-titled connecting loan can be used to eliminate a finances crisis. To possess individual customers and family members, bridge investment are reserved to have points within pick otherwise sales of a property. For example, for folks who own a house and are also selling they to purchase a different sort of one to, but romantic the offer for the new house just before you closed the new marketing to the last one, up coming a bridge loan makes it possible to safety your own will cost you in the new interim.

A quick publication will show you how a bridge loan functions, the benefits and you may drawbacks from the types of short-name financial support, plus ideas so you can secure bridge resource, if the you prefer happen.

Link Finance

This kind of collateral financing possess a job to relax and play people time there’s a detachment ranging from a request to own money and you may their access.

Particularly, link loans help homeowners power their residence equity and also make a great down-payment and or intimate with the a unique home as they expect its current the home of promote. Just like the almost all home owners need to have the proceeds from brand new product sales of their established where you can find contain the purchase of a new you to definitely, domestic equity bridge investment helps some one defeat so it monetary obstacle.

Extracting Bridge Finance

Preferred during the scorching real estate markets, link financing generally help somebody benefit from positive home industry standards or possibilities to purchase a home which they create not be able to pay for without any marketing of the newest assets.

Loan providers render bridge financial support once the an initial-identity substitute for beat an or insurmountable financial obstacle. Given that assets values consistently climb, controlling one or two mortgages is simply not realistic for many people, therefore connection loans, in the form of a primary mortgage or next mortgages , are particularly an increasingly popular option for individuals do financial money as well as payday loan Hartford close on their buy.

Bridge Financing Requirements & Can cost you

Particular loan providers wanted a firm deals agreement set up to suit your newest household. In the event the house is sold company, their mortgage broker will most likely not features much challenge having the financial support you will want to safeguards the brand new downpayment and you can settlement costs for the purchase of your new home in the form of a connection financing.

The fresh bridge loan rates of interest your own mortgage broker could possibly get rely into the multiple items, including your credit rating, loans to money percentages, together with link loan amount. Rates of interest for it kind of short-term financial support essentially are priced between the top speed around nine%.

Near the top of interest costs, getting link funding ensures that borrowers must pay the will set you back of this closing their basic mortgage loans, plus most of the courtroom and you may administrative charges.

Link Mortgage Advantages and disadvantages

Link funding is the better solution if there’s a detachment within closing times off a home purchases and you may people you desire the brand new continues of sales of their established assets in order to safer the purchase of the upcoming home. Link mortgage masters are:

- Fast access so you’re able to financial support

- Will bring individuals greater independence and alternatives for a house sales

- Faster software process than old-fashioned funds

- To own homeowners, additional time to offer the existing house will bring reassurance and decrease be concerned

A bridge financing are a good idea in a lot of things, however,, as with any style of money, he’s specific drawbacks, including:

- Broad variability in standards, will cost you and you can terms

- Interest rates should be higher than together with other kinds of money

- Potentially high risk, particularly without a firm purchases agreement, since a property deals commonly guaranteed up until they are finalized

- Maybe not an option for most of the home owners since the loan providers require the very least amount of house guarantee

- Borrower must pay expenses associated with brand new link mortgage also because their most recent financial

The latest Tribecca Advantage

We don’t require a strong sales in your home and then we promote each other first-mortgage and you can 2nd mortgage connection finance. To help keep costs manageable we could incorporate your own attention rates with the financing and that means you don’t have notice payments throughout the phrase of the link mortgage. All of our connection money is actually open without prepayment penalty and now we provide some of the low rates for the Ontario.

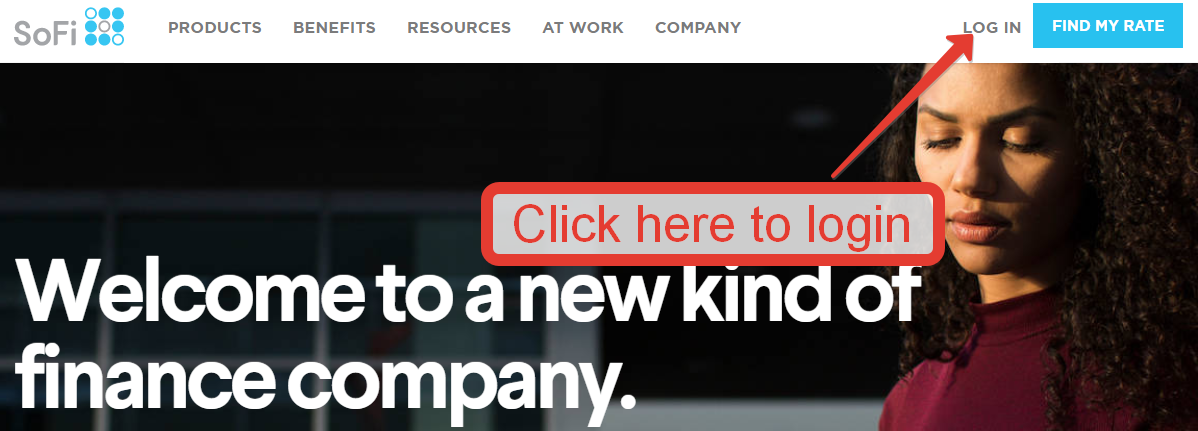

For those who have questions relating to bridge capital choice, all of our lending experts during the Tribecca can help you look at the options. Click the link add a question otherwise phone call 416-225-6900.