- Loan-to-value (LTV) ratio: The mortgage-to-worth ratio (LTV) are calculated of the separating the costs facing your house (each other your current home loan therefore the brand new home guarantee mortgage) from the property value your property, since dependent on an enthusiastic appraiser. Such as for instance, a $350,000 home with $150,000 leftover into the home loan will have an LTV proportion away from 43%. Include a $50,000 home equity mortgage create produce a mixed mortgage-to-well worth (CLTV) ratio from 57%. As with DTI ratio requirements, lenders do not have a set-in-brick amount you need to speak to some loan providers allowing right up in order to ninety% CLTV.

- Name duration: An effective way to reduce the interest rate into a home equity loan is by choosing a smaller identity. Like, an effective fifteen-season mortgage normally boasts a lower life expectancy rate of interest than simply an excellent 30-seasons mortgage. Although not, shorter-identity loans have a tendency to usually feature large monthly obligations.

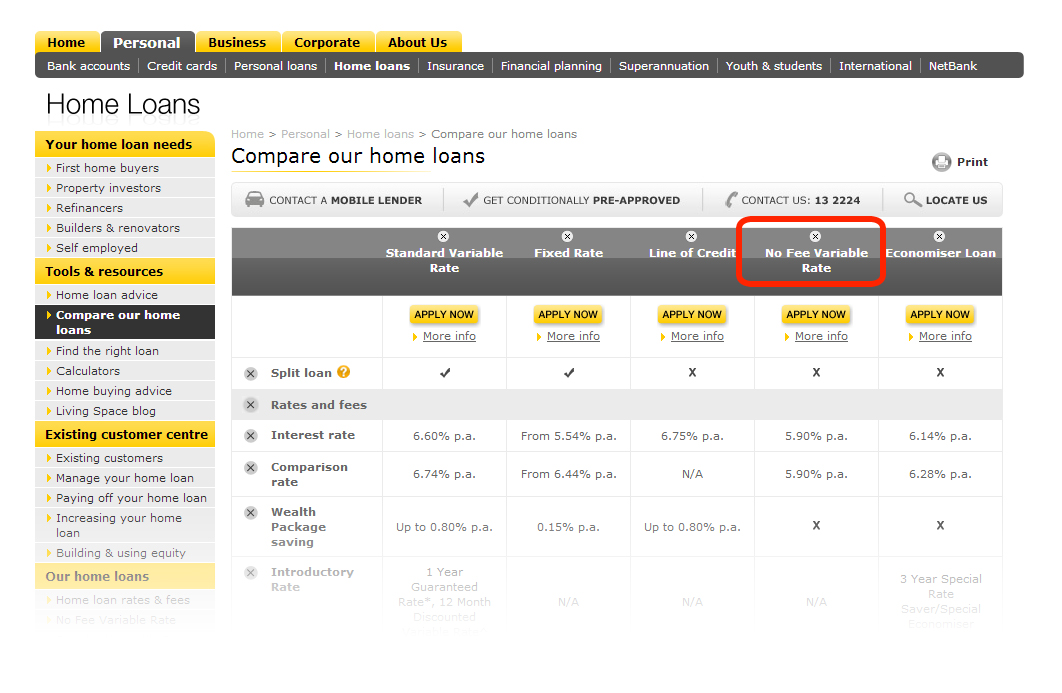

- Examine loan providers: Tend to overlooked, a terrific way to lower the rate of interest on your own domestic guarantee mortgage is via getting speed quotes out of multiple lenders. For every lender can offer your a different rates, and in case you really have competing also provides, a loan provider is generally prepared to render an even down price so you can safer your company.

Interest levels are usually seemingly lowest towards house equity fund. Although not, it is well worth noting you to definitely pricing are very different depending on the sorts of loan that you will be selecting along with your situations. Such as, a property guarantee loan almost always features a diminished rate of interest than just an unsecured loan or bank card.

On the other hand, you may find down claimed rates of interest to your a house collateral line of credit (HELOC). It is critical to remember that most HELOCs include varying rates, but the majority family guarantee fund come with repaired prices. A fixed-price financing can get a comparable prominent and you may desire commission most of the day on life of the borrowed funds. An adjustable-price financing adjusts while the interest levels flow, definition their payment per month is also rise otherwise fall at an effective moment’s observe as a result. Price products are just one of many differences between household guarantee loans and you will HELOCs.

Things to get a hold of when comparing household security loan lenders

Besides rates, there are trick points that you really need to pay attention so you can when comparing loan providers. Think about, if you are borrowing 10s otherwise thousands of dollars, the interest rate is just one basis to look at:

- Domestic security mortgage conditions considering: When searching for household guarantee loan companies, visitors it is really not particularly looking a home loan. Certain may offer 520-seasons terms and conditions while others may offer ten30-12 months terms and conditions. Come across a lender that gives terms and conditions that suit your financial budget and you will needs.

- Book loan unit features: Not all the lenders are built an equivalent, and lots of lenders have costs and closing costs with the domestic guarantee financing facts, while some cannot charges closing costs or other charges. Significant fees you can expect to remove or even erase the great benefits of lowest rates.

- Customer support listing: Handling a reputable lender having an exceptional support service checklist is a must. You are trusting the financial institution with your own suggestions and you may security when you look at the your house, so you could need to favor a well-recognized financial that have confident buyers feedback.

- Most other qualities: The majority of people wanted its cash becoming as simple as possible, that will suggest with all your valuable borrowing products, just like your household collateral financing, home loan, checking/savings account, credit card, and all the with similar business.

Closing advice: Ways to get a low household security mortgage rates

Reducing the rate of interest in your household security loan may save your self you a lot of money in the long run. The good news is, there are numerous the way to get a lower household collateral loan interest – off improving your credit score so you can comparing lenders’ terms and loans Indian Hills you can fees before you make a choice.